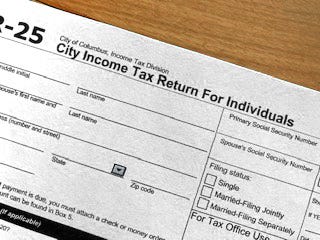

city of cincinnati tax forms

Call 513-352-3827 to have forms mailed to you. Please be advised that if you choose to file your City of Cincinnati tax return electronically the City may correct the tax return or require you to resubmit revise or amend your tax return with accurate data.

Irs Tax Forms What Is Form W 2 Wage And Tax Statement Marca

CITY OF CINCINNATI INCOME TAX DIVISION MAGNETIC MEDIA REPORTING FOR TAX YEAR 2009 For submitting annual Form W-2 information.

. If your employer did not withhold the local tax at the rates shown you are required to file a Cincinnati tax return. Offer helpful instructions and related details about City Of Cincinnati Tax Forms - make it easier for users to find business information than ever. Cincinnati Income Tax Division PO.

Dinner Restaurants Near Me Reservations. Italian Restaurants Milwaukee. To have tax forms mailed to you or with questions please call.

Do you have a paystub with a date close to 1022020. All Cincinnati residents regardless of your age or income level who receive taxable compensation are required to pay the City of Cincinnati income tax at the rate of 18 effective 100220 and 21 prior to 100220. If an employee opts to have their city taxes withheld via payroll deduction no form filing will be necessary on.

Column D How much tax was paid to Work-In City for Cincinnati Residents ONLY-Limit to 21 Tax Rate Column E Determine how much was earned in the period after October 1 2020. Generally this is Box 19 on the Form W-2 Local Taxes Paid. This form is to be used by individuals who receive income reported on Federal Forms W-2 or 1099-MISC or.

Credit is limited to the local tax rate used 21 or less. All cincinnati residents who receive taxable compensation are required to pay the city of cincinnati income tax at the rate of 21 thru 100120 and 18 effective 100220. Residents of the City of Cincinnati may claim taxes paid to another city up to 21 of the Qualifying Wages reported on each individual W-2.

Residents of the City of Cincinnati may claim taxes paid to another city up to 21 of the Qualifying Wages reported on the W-2. Tax rate for nonresidents who work in Cincinnati. Total Qualifying Wages Enclose W-2 Forms Copy of Federal Tax Return.

35 effective december 1 2002 is earmarked to the renovation and expansion of downtown cincinnatis duke energy convention center and the sharonville. It is the employees responsibility to comply with all Tax Ordinances. Residents of the city of Cincinnati may claim taxes paid to another city up to 21 of the Qualifying Wages reported on the W-2.

Box 634580 Cincinnati OH 45263-4580. Box 634580 Cincinnati OH 45263-4580. Complete the tax form and mail with a check made payable to city to cincinnati to cincinnati.

Top High Schools In Ohio Top Schools In Ohio 2021 K 8 Top Drayage Companies. The account information contained within this web site is generated from computerized records maintained by the City of Cincinnati. Form fr 7141 miami avenue cincinnati oh 45243 city of madeira tax office make check or money order to.

If an employee opts to have their city taxes withheld via payroll deduction no form filing will be necessary on April 15. Line 4 Enter the amount of withholding taxes paid to Cincinnati. Line 7 Enter the amount of taxes withheld for or paid to another city.

Printing and scanning is no longer the best way to manage documents. Generally this is Box 19 on the Form W-2 Local Taxes Paid. Remember to send us copies of your federal tax forms to assist us in processing your return quickly.

City Tax Forms are in Adobe Acrobat format. To view and print Adobe PDF files you must have Adobe Acrobat Reader installed on your computer. Go digital and save time with signNow the best solution for electronic signaturesUse its powerful functionality with a simple-to-use intuitive interface to fill out Tax cincinnati form online eSign them and quickly share them without jumping tabs.

Complete the tax form and mail with a check made payable to City to Cincinnati to Cincinnati Income Tax Division PO. City administration is recommending. Pay online if you do not want to use a printed form.

While every effort is made to assure the data is accurate and current it must be accepted and used by the recipient with the understanding that no warranties expressed or implied concerning the accuracy reliability or suitability of this data have been. Mexican Restaurants In Albuquerque Uptown. Credit is limited to the local tax rate used 21 or less multiplied by the.

Box 634580 Cincinnati OH 45263-4580. Nonresidents who work in Cincinnati also pay a local income tax of 210 the same as the local income tax paid by residents. Residents of the City of Cincinnati may claim taxes paid to another city up to 21 of the Qualifying Wages reported on each individual W-2.

Complete the tax form and mail with a check made payable to City to Cincinnati to Cincinnati Income Tax Division PO. Click on the icon below to obtain the latest version and more information on downloading and installing from the. Handy tips for filling out Cincinnati tax forms online.

To exercise this option the employee must submit the. Residents of Cincinnati pay a flat city income tax of 210 on earned income in addition to the Ohio income tax and the Federal income tax. Line 5 Enter the amount of taxes withheld for or paid to another city.

Tax forms and municipal income tax ordinances are available below. The majority of Cincinnatis roughly 70 million carryover from the last fiscal year will be put in reserve. Pay online if you do not want to use a printed form.

City Of Cincinnati Tax Forms. Credit is limited to the local tax rate. The City of Cincinnati cannot guarantee the accuracy of the information generated by the online filing tool.

Mail all payment coupons to. Each submission of W-2 data must be accompanied by one or more City of Cincinnati Form W-3 Wage Reconciliation returns paper copy required for each RE record within the submission file. City of Cincinnati tax forms should be filed annually on or before.

If you have any questions. Microsoft Word - 2012 Individual Return revised.

Ohio Tax Advice What To Know About 2022 Work From Home Refund

Today S Document From The National Archives Tax Forms Federal Income Tax Income Tax

Art Word Bound Price Hill Health Clinic Mural Fundraiser Mural Clinic Fundraising

Last Minute Dash When Where How To File Those Last Minute Tax Returns Tax Return Tax Paying Taxes

Irs Form 945 How To Fill Out Irs Form 945 Gusto

Top 10 Healthiest Cities In Us Centrum New Orleans Healthy

Greenville City Tax Fill Online Printable Fillable Blank Pdffiller

Leaving Certificate Template New Valid Tax Certificate Template Metafps Com Donation Form Certificate Templates Receipt Template

What To Do If You Receive A Missing Tax Return Notice From The Irs

Child Credits Work From Home Crypto All Affect 2021 Tax Returns

Irs Tax Forms What Is Form 1040 Sr U S Tax Return For Seniors Marca

Order Form Template Excel Check More At Https Nationalgriefawarenessday Com 18693 Order Form Tem Order Form Template Excel Templates Order Form Template Free

5 Things To Know About Taxes And Working From Home In 2022 Working From Home Things To Know Kettering

Tax Season 2022 How To File Correctly Your Taxes And Get Your Refunds Faster Marca

House Hunting Across The Nation Infographics Rental Property Real Estate Rentals Real Estate Infographic

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

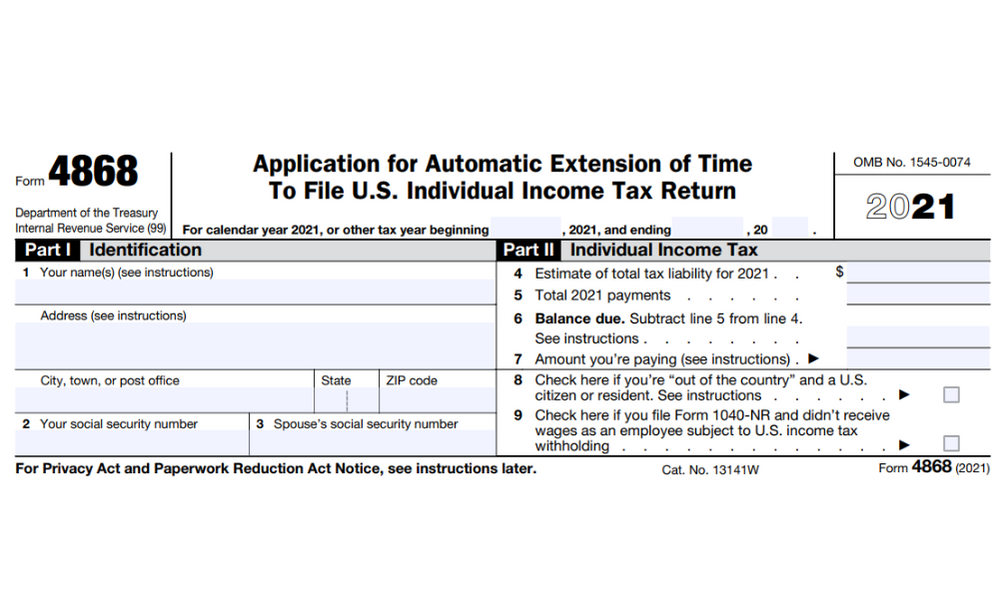

Irs Form 4868 How To Get A Tax Extension In 2022 Marca

Checklist Of Documents For Filing Income Tax Return Tax Checklist Income Tax Return Income Tax